Check Your Accountant's Work

The Problem with Accounting

For small businesses - dealing with tax is a massive headache. Many owners / managers are completely incompetent. They would rather not do it, or handball it wholesale to a suburban accountant. Typically the owner would dump a folder full of illegible receipts in front of their book keeper:

“Here, deal with this”

… and then abscond, magically hoping their accountant takes care of everything.

When presented with their reports for confirmation: do they have the competence and ability to verify or audit their own statements?

Not a chance - even if they wanted to. And most don’t.

Here are some key things you need to know:

The Philosophy

-

You’re in charge: not the accountant. They answer to you, rather than the other way around. Leverage their expertise.

-

You Must Check Always check whether they know something. Ask them a simple question: basic book keeping. Or ask them something which should be elementary for them. e.g. “Do you use MYOB? Yes? Ok then what’s the difference between NT and FRE when creating an invoice?” They should have an answer. If they don’t, you need to find out why. Or ask them to post some basic journal entries. It is a 10 second conversation. The answer should fly out of their mouths. e.g. If I’m recording an increase in the account of an asset: should that be a debit or a credit? (It should be a debit).

Overall Snapshot

For those who are particularly busy: it is very difficult to look into the details. Stand back: from an over-all viewpoint, do the numbers look right:

-

income vs expenses vs tax paid: If you’re a billion dollar enterprise, and you have 10 billion in expenses: is that unusual? This is your overall sanity test. If your income is $10, then why are you paying: $10 in tax?

- Expenses: check all are there, none are missing, and no-double counting.

- Revenue: check all are there, none are missing, and no-double counting.

- Loans: Allocate them correctly. If you lend, you should have a receiable, rather than having a negative liability.

Most Important: You need to know basic book-keeping

Once you do this, idiotic transactions cannot be hidden. Because you will be able to question them.

Items to Look Out for:

-

Ensure internal transfers are not accounted as part of your sales-tax records. If you accidentally include internal transfers, then your sales tax payables will be astronomical - through the roof.

-

Cash or Accrual Accountants are careless. Our previous one (allegedly) was not consistent. Submitting returns in one year on a cash basis, and in another on an accrual basis. Such errors can only be discovered if you carefully audit your own accounts.

-

Suspense accounts: When things don’t balance, it requires a little bit of work to find out what went wrong. Some accountants are too lazy to put in the effort required - it is much easier to make the books balance by using a “suspense account” - which is just a place to dump unbalanced figures, under the rug, to make it work. Balancing is an annoyance. Watch out for accountants who do this.

-

The Proper Tax Code: Make sure you apply the proper tax codes to each transaction. The nuances are important: e.g. N-T vs FRE vs GNR. If you accidentally apply the wrong one, you could find that certain transactions end up on the wrong report. If your accountant is sloppy (or rather the accountant’s WFH book-keeper sitting in Mumbai) you could see some non-sensical results.

Accountants to Avoid

-

Accountants who do not answer you: email black holes. When you call them (and I don’t like calling anyone) their #1 objective is to get you to: (i) shut up, and (ii) get off the phone.

-

Accountants with bad communication skills: It is helpful to deal with someone who speaks your native language. The minimises the potential of miscommunication. Those with poor English skills are hard to understand.

-

Dishonest accountants: If they actively suggest that you lie - for convenience - that is a big warning sign (in my book). Because if they are openly trying to be convenient with you, they will also lie for the sake of convenience behind your back. This is a no-go for me.

-

Dishonest practices: My objective are not to obtain some benefit “if I can get away with it” but to do what is right and just, according to the hierarchy of authorities I answer to: God, Nation, State, Council, Church, Family. I will not openly declare which one holds primacy, but it should be obvious. One of our accountants insisted on revaluing our income, every quarter, down to zero, so that we would not have to make PAYG installments to the tax office every quarter. While I detest this type of taxation (which I regard as theft), we would effectively have to perjure ourselves by declaring zero income. I have no interest in doing so. I should have taken note here, because this same accountant then turned around and gave us bad advice.

-

Gives bad advice: You hire an accountant so they can give you competent and correct advice. Sometimes there are gray areas: e.g. “Q: Accountant, what are the tax implications of XYZ” and they might say “I don’t know”. You pay big bucks, and that’s the answer you get? What exactly did I pay for then? In other cases: there are no gray areas. But pure incompetence. When my accountant gave me advice that was so patently incorrect, I resolved to fire them. Whom should I hire in their place? You are better off taking your chances hiring any fool who passes by: they cannot possibly be any worse, but they may be better.

-

Accountants who flip: This is where your accountant hires a bunch of low paying book-keepers in India. Those guys do not know you, and don’t care about your books. If they make a mistake, that’s your problem. This is a nightmare. The worst part is that, if you do not check, they’ll get away with blue murder.

-

Lazy Accountants: Where they are not willing to put in the hard work to fix something? e.g. A mistake in a deed? You should destroy that deed and re-print it. An accountant of ours was too lazy to do so. This calls into question the entire deed, and will come back to bite you in the future, as it did me.

Accounting, and HR are two functions that CANNOT be outsourced. It must be directed from the top with close supervision.

Potential for Mistakes

- Cash vs Accrual. Pick and choose. Cash is easier.

- Assets vs Liabilities. If you borrow money or lend money to the firm - make sure that your accountant classifies it properly. They can make mistakes. Some don’t know the difference.

MYOB Account Headers

gst_collected- this is the GST you have collected on your invoices / income. 10% top of the line must immediately go to the tax office. Regardless of whether you make a profit. This is a controll account.-

gst_paid- When ever you make a purchase, 10% is given to the tax office. - The total GST you pay must be:

gst_collected - gst_paid = total_to_pay_to_tax_office

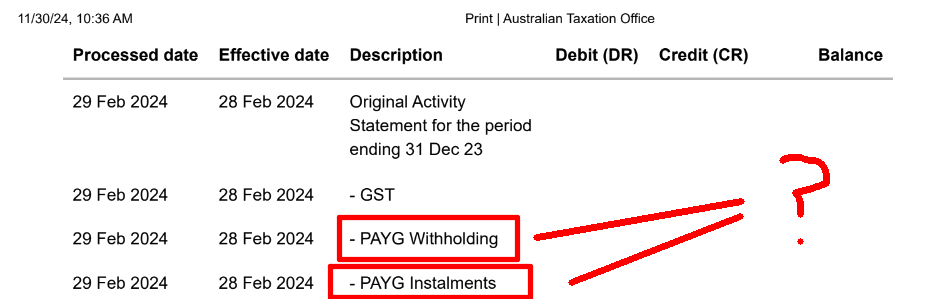

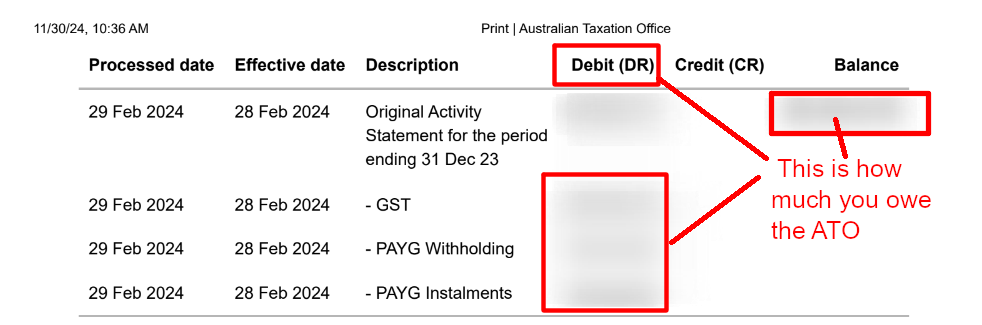

Activity Statement Account Names

You can trust the ATO to give you account statements without definitions:

PAYG Witholding- this pertains to any tax withholding based on an employees’ salaries.PAYG Installment- pertains to income tax (business income tax).

PAYG Payroll

When you do a payroll entry, these are the journal entries created by MYOB:

DRdenotes: debit.CRdenotes: credit.

DR: Wages & Salaries (expense account) $ a + b

CR: 1-1110 Cheque Account (asset) $a

CR: 2-1410 PAYG Withholding Payable $b

DR: 6-5120 Superannuation (expense) $x

CR: 2-1411 Supernnuation Payable $x

Now when you actually make the payments you must:

- Reduce the Super Annuation Payable (which is a liability account)

- Reduce your bank balance (which is a cash account).

DR: 2-1411 Supernnuation Payable $ x

CR: 1-1110 Cheque Account (asset) or bank account: $ x

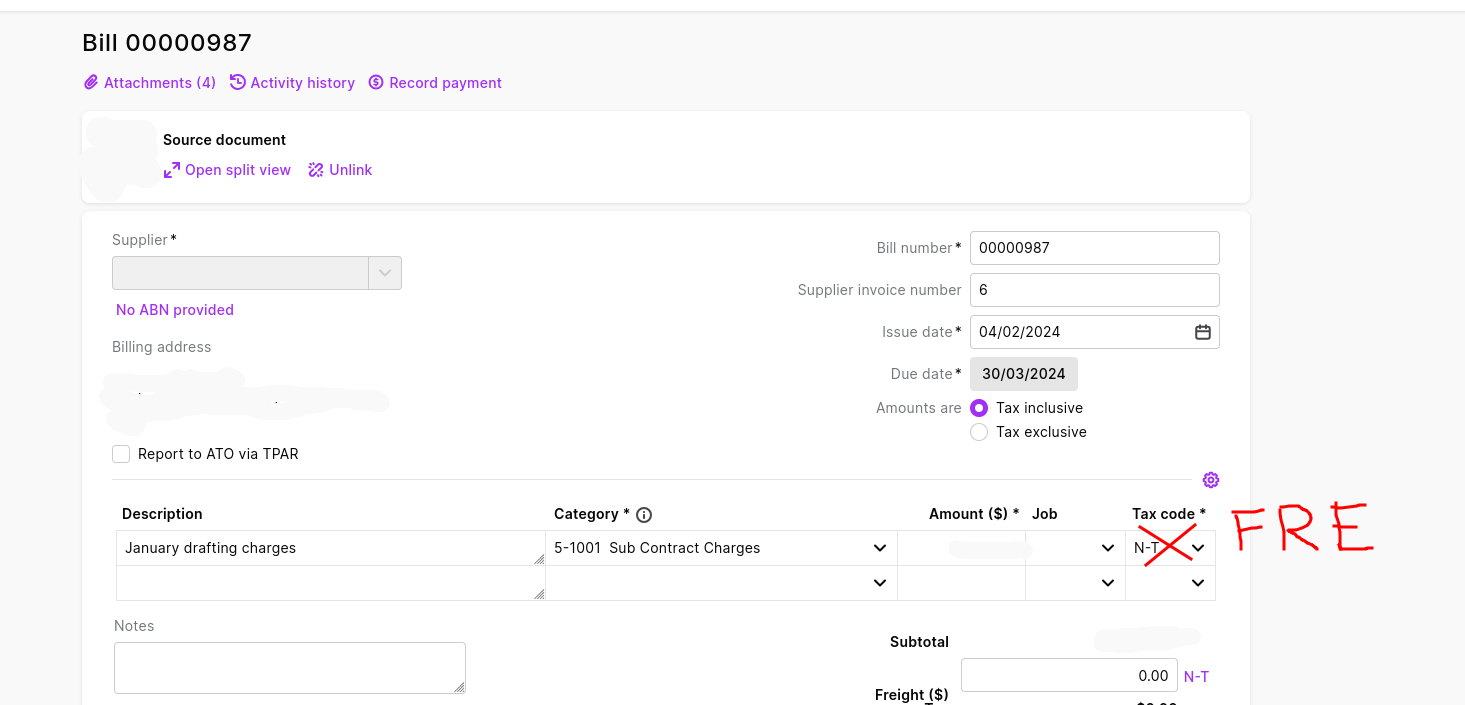

Tax Codes on Transactions

Refer to this post (from Myob) and also this forum question.

N-T: These are transactions that are entered but are not reported on the BAS. i.e. bank transfers from one account to another. They are not goods or services transactions.N-Tare not to be included on BAS.FRE: These are transactions where the GST amount is $0. GSTFREitems are included on BAS .GNR: Where the supplier is not registered for GST but has an ABN.

Pop-quiz: a director uses the company card to make a personal payment (transaction). When this amount is repaid: should it be classified as N-T or FRE? I have classified it as N-T because: (i) this should not be treated as ‘income’ at all, (ii) the transaction has no GST basis, I do not want it to be treated as non-GST income at all.

Bills and Tax Codes

Overseas Transactions

Suppose you purchase services from outside Australia. There is no GST payable on such transactions. It cannot be an N-T tax code. Why not? Because N-T implies transactions which are not goods and services - however this is a goods and service transaction. Therefore it should be a FRE transaction:

For example, this is an incorrectly entered tax code:

Accidental Personal Purchases

# when paid from

# director to repay

DR 1-1201 - Accidental Purchase - Account Receivable $accidental_purchase

CR master-card $accidental_purchase

And then when it is repaid:

DR Cash $(funds repaid)

CR 1-1201 - Accidental Purchase - Accounts Receivable (Director to Repay) $(funds repaid)