Blue Ocean Strategy

The following is what I take out of the book. It is not an exhaustive summary. I add my own ideas where relevant. I have also excluded Tek1 as a case study.

I would encourage those wanting to study the ideas diligently to simple obtain the book yourself. Note: I am not shilling the book nor profiting from it.

The key concept:

Focus on innovating

- Build new things that are valuable for people: Focus less on copying and doing what your competitors are doing. i.e. competition should not occupy the center of strategic thinking. In other words, just because a competitor is doing it does not mean that buyers value it. i.e. stop looking to the competition: value innovate and let the competition worry about you. Create a new market space, and competition becomes irrelevant. i.e. ‘innovating at value’.

- Industries can be shaped. You can shape it.

- Strategic thinking can be unlocked systemically.

- An essential aspect of strategic thinking is: (i) trust, (ii) commitment and (iii) voluntary cooperation of various actors in an an endeavour. Mechanically following orders simply will not cut it. Staregy and execution must go together.

Why is blue ocean thinking important?

For survival.

Creating Blue Oceans

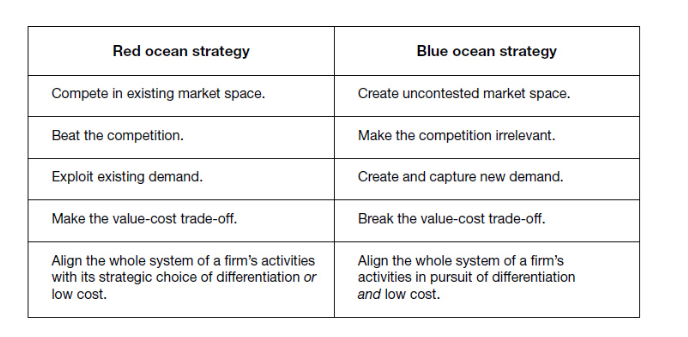

- Red ocean: competing in a highly general and commoditised market place. When competing here you would: (i) position as a low cost provider, or (ii) have differentiation or some other focus or angle.

- Blue ocean: (i) demand creation and untapped market space.

(A) The corner stone of blue ocean strategy is “value innovation”

-

You need innovation, but you also have to think about: utility, price and cost positions. If you don’t, then you will innovate and sow, but someone else will reap the harvest. The perfect example of this is Xerox Parc - whever everything in modern computing was essentially created there: GUI, mouse, windows, networking via ethernet. The value was there but it was too expensive.

-

At the heart of blue ocean strategy: we want differentiation and low cost simultaneously. i.e. by eliminating or reducing things that an industry competes upon, and buyer value is offered by raising and creating elements that the industry has never offered. In other words, to cut costs while also increasing value to buyers: viz: simply improving production line efficiencies may be beneficial to yourself: but what does it do for buyers? You need both in order for blue ocean to work.

i.e. Typically most would compete on established lines: offering more, for less. But we need to be:

- Offer alternatives (as opposed to being competitors). i.e. going to the cinema vs staying at home and watching sports - these are alternatives. Whereas going to Hoyts vs Village - these are competitors. Rathert than competing with Hyots, it is better to be an alternative to sitting at home and to get those customers.

- You want to capture non-customers (as opposed to customers).

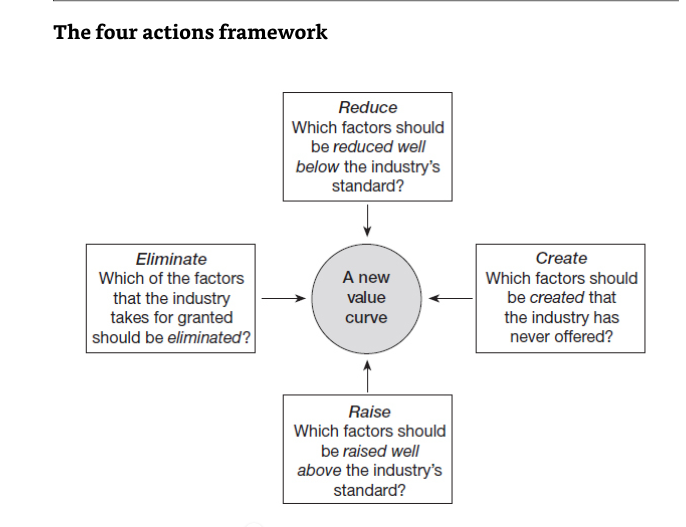

(B) The 4 Actions Framework

How can you break out of the more for less + minute differentiation model? Consider the four actions framework:

First list out: What does the industry and / or Tek1 compete on?

- Which of the factors that the industry takes for granted should be eliminated? i. Is there any thing which has little to no value or anything that detracts from value.

- Which factors should be reduced well below the industry’s standard? i. What is over designed and/or uneeded in the industry? Which increases cost for no gain? ii. Look at your costs. And decide what can be reduced.

- Which factors should be raised well above industry standard?

- Which factors should be creatd that the industry never offered?

You can even place this in a grid. See below for Yellow Tail’s eliminate-railse-reduce-create grid:

(C) The Qualities Required to Implement 4 Actions

(i) Focus & Divergence & Tagline

If you want to separate yourself, you need to (1) focus, in order to separate yourself from others. e.g. Yellow Tail cannot be all things to all people at the same time. (2) Tagline You must be able to simplify all of that into a simple tag-line. And (3) Uniqueness or Divergence.

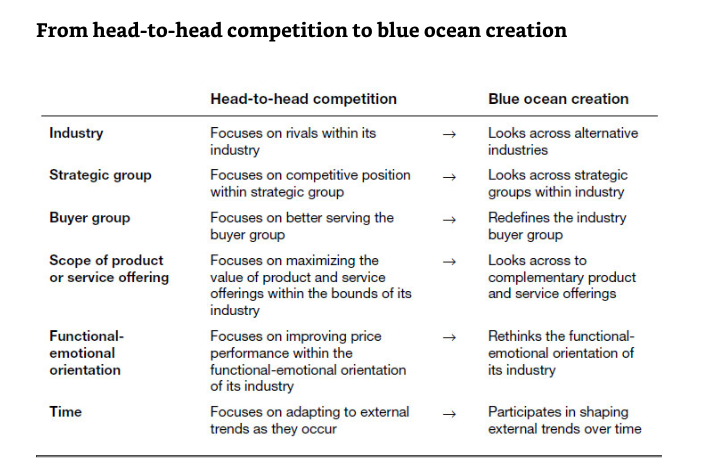

(D) Path 1: Look across Alternate Industries

Look at alternatives within the same relative domain.

e.g. the restaurant business might be in the same domain as the cinema business - people want to hang out and do something. But the medium of doing so might be slightly different.

e.g. Curves vs traditional gyms.

e.g. Cars: high end cars vs low end cars.

If you understand what is going on, you may be able to tailor something which is missing.

(E) Path 2: Look across Strategic Groups within industries

- i.e. a group of companies within an industry that pursue a similar strategy.

- They are typically ranked on: price and performance.

The typical behaviour is to focus on competition within a group. e.g. if you are provided first-class seats, then you would be competing at this level. If you were BMW, you would be competing against Jaguar, but Toyotas would be in their own lane.

(E) Path 3: Look across the chain of buyers

i.e. understand the current chain upon which the eventual product is delivered.

Usually there is a chain of buyers involved, before a product is finally used.

e.g. purchasers might be different to the end users. They might care about cost (without regard to the final product)

(c) What factors should be created that the industry doesn’t offer?

Path 3: Chain of buyers:

Let us understand the chain of buyers with all work that Tek1 understakes.

- We have an owner (government) who comissions the work.

- They hire consultants.

Path 4: Focus on what happens before and after you provide your service

i.e. help people get where they want to go.

e.g. if you are an airline, what if you helped people get where they want to go? If you are a cinema theatre - what happens before and after the experience? i.e. people have to leave the house, they have put on some proper clothing, get out into the cold, hire a baby-sitter, then park, then walk up the stairs, wait in queues, then watch a movie with disturbances.

Is there any part of the chain that you can cut-out? i.e. Netflix cut out the pain of getting to cinemas, and the pain of watching ads on TV.

or like Dyson: remove the vacuum bag: i.e. you have to buy refills etc.

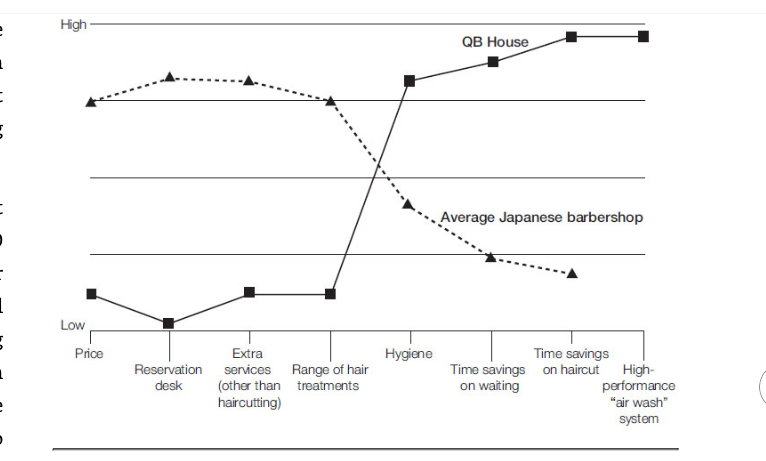

Path 5: Look across Functional or Emotional Appeal to Buyers

- Perhaps add or remove emotional elements. e.g. QB House removed shoulder massages, face / skin treatments, hot wet towels etc.

- Cemex added it: e.g. with Cement tanda - a Mexican community saving scheme via the Patrimonio Hoy program. This boosted sales.

- Starbucks - shift from commodity coffee to a community hub.

- Traditional Insurance + Banking: focused on client-broker relationship. What if you could eliminate brokers by making your product clear and simple - and online. Handle claims online, and pass the savings on. Similar concept for Charles Schwab and Vanguard (Index funds).

Path 6: Look at trends across time!

i.e. Trends typically must be decisive to (your business), irreversible, and they must have a clear trajectory. i.e. cost of computing. Then ask:

- What would happen if the trends were taken to its logical conclusion?

Microsoft recognised that the cost of computing would decrease, and they bet accordingly. Similarly Apple saw the flood of illegal music on Napster etc. that was shared online - and created the ITunes store - where they could sell music.

Case Study: Cirque du Soleil

Normal circuses - the existing paradigm:

- Used animals (expensive: transport, medical, food and management)

- Big name clowns (expensive - without doing that much to the bottom line).

- Three rings - i.e. circuses had x3 performances at the same time. This added much to the cost, but the viewing experience was somewhat confused.

Cirque du Soleil reasoned that:

- the “big names” are not really that important. The fame of a circus clown is trivial to that of a big name actor.

- cut out the animals together.

- have one ring, not three.

- have a theatrical experience, and not just a circus experience: added atristic music, and dance, story-lines with intellectual richness. Original music scores, costume, lighting, and a loose theme between acts. they kept clowns, but moved away from slap stick to a more artistic / enchanting style.

- they kept the tent, but made it more up-market - removing the bench and saw dust.

- More over they have multiple productions - so people would return for the different acts.

Cirque du Soleil eliminated the circus cost structures, but priced it much higher - similar to a theatre ticket.

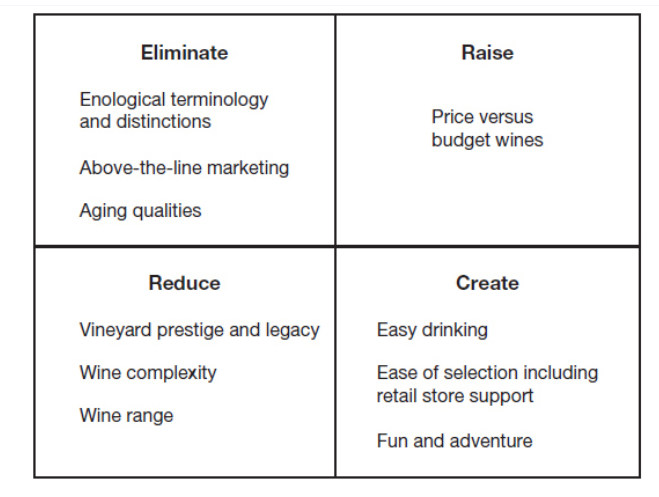

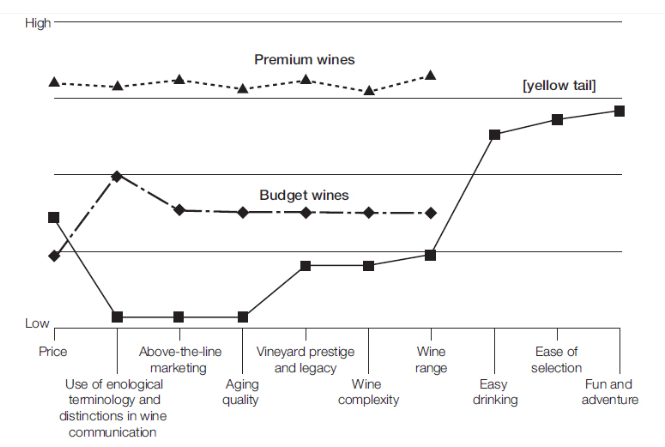

Case Study: Wine Making

How did Yellow Tail compete?

First establish what other people compete on:

- prestige: labelling, estates, packaging

- branding: above the line marketing.

- complexity / taste profiles - as determined by expert wine tasters, according to wine judging shows etc. produced by: soil, season, grapes, tannins, oak, aging process.

- Age

- wide range.

- Easy drinking

- Ease of Selection

- Fun and Adventure

Note: “competition” denotes an existing market. How do you define a market? By wine? By spirits? By beverages? By food and beverages? By gifts?

Yellow Tail come in at a price that was slightly above the budget price for wine, they got rid of things they thought was unimportant, and added things which they thought people would desire.

- Price: cheaper than premium, slightly higher than budget wines.

- Yellow tail cut everything they thought was unecessary.

- Their innovation: most people don’t have the time and inclination to focus on complexity of taste, acidity, tannin, oak, age, fancy estates, or necessarily care whether some sommelier (which is a wine afficionado) renders his expert opinion on a wine. They just want something easy to drink, simple, appealing - they came up with a fruity flavour. At least this is my interpretation.

- Marketing: remove all the complicated jargon from their boxes. Bright colors. They also gave salespersons free Aussie merchandise i.e. prompting them to recommend Yellow Tail. Existing brands making premium wine spent millions in marketing - which might not resonate with the ready to drink, beer and cocktail customers.

- They also reduced their selection of wines, minimising their SKUs and optimising for volume. They also used the same bottles for different types of wine: red and white - this was never done before. But I don’t think consumers care.

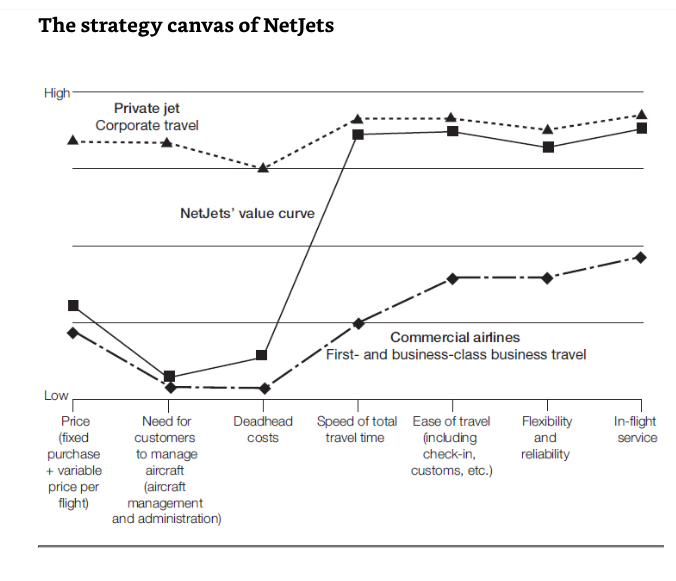

Case Study NetJets (Reviewing Alternatives)

You gotta look at alternatives. i.e. Net Jet could say they are in the “commercial aviation sector”………but let’s look at alternatives - both expensive and cheap.

- Car

- Private Air travel

- Train

How can you divide up existing services to drive down price, and add different bits of value? Then you get a blue ocean. If you add innovation on top of this - then you are on a winning wicket.

Basically an uber except for private jets.

What do they do differently?

Cheaper than outright owning a private jet:

- Don’t have to pay for the full jet, maintenance, license, hanger fees, insurance etc., large deadhead costs.

Benefits vs Commercial:

- Is faster: point to point (more locations available, customs is near the plane so you can skip queues).

- You get 50 hours of flight time.

- More flexible.

- Better in flight service.

i.e. NetJets have worked out that you don’t actually use a private Jet all the time - most of the time it is sitting idle. So rather that compete in existing markets, they created their own “new” market.

Further examples were given of NTT DoCoMo, Home Depot adding professional contractors on their shop floor so you can get free expertise.

Curves, Champion Enterpreises, Polo Ralph (Looking across alternatives)

- Look across strategic groups: replace what’s uneeded, and add what IS needed.

e.g. Curves:

- there are high end gyms in premium locations

- those gyms allowed men.

- those gyms focused on expensive equipment i.e. weight resistance machines.

- but curves have low start up costs, low space requirements, do not use big weights

- they are located in non-premium suburbs, focused on busy women, who want to minimise the time fighting traffic.

- they are focused much more social interaction, and relationships.

My own personal opinion: I have incidentally noticed that most of these machines are hardly used, are expensive, and arguably uncessary. If I were to start up a gym, I would remove them entirely and focus simply on barbels. Come to think of it, my current gym: training day - does not have a section where they have heavy dumbells!

Case Studies (Looking Across Buying Groups)

Big Pharma: Focused on selling to doctors. There were syringes that used to be used to administer insuling. Novo worked out that you can administer it using a special “pen” (innovation) and that they could market this to inviduals (vs doctors) who would perhaps then influence the purchasing decision. They subsequently innovated on then pen by making it refillable, and then with an electronic display. All of this came after innovating on the insulin itself.

Bloomberg: Traditional financial news was done by Reuters and Telergate. It was sold to IT managers. Bloomberg realised that the real purchasers are traders, not IT guys. They innovated by selling to traders, with: (i) better / easy to use terminals, (ii) better UI - can see all the information without needing to open numerous windows, (iii) value added services - i.e. analysts had to calculate things with pen and paper but Bloomberg automated all of that for them, (iv) they even provided online services i.e. ‘chocolate / wine’ on demand for busy traders who needed it.

Case Studies (Looking Across Functional or Emotional Appeal to Buyers)

QB House e.g. QB House (barbers): haircuts used to take 1 hour. Long queues. It was full service with coffees and massages. All of this was purely emotional. Haircuts used to be expensive. However, if they reduced the time taken, they could charge less, and provide a faster service. i.e. they could be more profitable, because their hourly billing was increased, less retail space required, less barbers required.

Case Study: Tek1

(a) What does Tek1 compete on?

- Price

- Quality

- Insurance

- Local Presence.

- Design Review and Value Engineering. Other firms don’t compete here.

(b) What does everyone else compete on?

-

Overseas detailers compete on price. Most of them employ pirate licenses. Their quality may also be questionable given: (i) Indian cultural attitudes, (ii) their incentive structures (i.e. when will fabricators pay them, and secondly will fabricators pay them at all). The cheap fabricators will not want to pay their detailers. If they do pay, they will pay as late as possible. Competing on this wicket is probably a losing battle.

-

Other detailing houses: i.e. are basically large fabricators, or listed companies, or large engineering consultants - they internalise their operations and have large bases of consultants / detailers operating off shore. One large American steel producer has offices in the Philippines. They compete by winning manufacturing work, large projects, and they employ themselves to complete those tasks.

Other possible services (i.e. more for less):

Documentation services:

- variation

- statuses

- revision management (this will eliminate a lot of problems).

- Better system of mark-ups and issue closing. i.e. blue beam, but it has its problems.

Services which leverage the following:

- API based skills.

- Designs which require API skills.

- Marketing and demonstration of skills via case studies.

- Training

- Certification

Further potentials:

- ITP

- Scheduling

- Ordering

- Producing materials, leveraging our expertise in shop drawing. This allows for the expansion of capital.

- Tendering services.

Consultation Services:

- Complex buildability issues at the design stage.

- Cheaper costing at the design stage + lower costs.

- We can do the structural steel and the precast together at the same time.

- We can do the structural steel shop drawings before tendering because:

- (a) this allows all the RFIs to be sorted out, and the main delay points to be solved.

- (b) more accurate tendering can be done once the shop drawings are sorted out provided:

- (c) the builder re-iterates that this is everything that needs to be supplied. Extras can be set at pre-determined rates.

- (d) Coordination issues can be logged and raised.

-

We can prove knowledge: i.e. certification of issues - so that people are confident that we know what we are talking about. This can shed transparency on things like:

(i) caulking.

-

We can suggest modification of that structure: i.e. better value engineering.

(i) exchanging of materials for less complexity. (ii) combining panels.

-

Entire issues re: risk and liability.

(a) bank loans cost money and require collateral + guarantees. This raises the price of items, without really providing too much additional value.

Immediate changes to the quote app:

(a) Allow value based pricing instead of variation by hour.

(b) Allow for clients e.g. Xavier to upstream their status updates.

(c) Allow for some choice in the financing of the project.