The 7 Powers: The Foundations of Business Strategy

This is my own summary, notes, thoughts on the book - I have added what I thought was important and elided other things, because I didn’t need to note it down. If you are interested in reading the original source - do yourself a favour and purchase it: it’s just $12 on Amazon Australia - or search for “7 Powers: The Foundations of Business Strategy” by Hamilton Helmer and get it an any bookstore. It is a reasonable cost, to help you determine/understand where you are going to devote years of your life. Why sink it in unprofiable ventures?

Above all:

- you must have an advantage (or series of them) that cannot be arbitraged away. Be unique - as unique and as useful as possible.

- Save someone labour. The more labour you save, the more useful your product.

In order to get an advantage:

- improved quality, (through a new, or massively better product) or improved cost. i.e. you need a superior benefit

- and you need it to be sustainable - i.e. you need one or more of the powers listed below.

…which can only be brought about by innovation.

Where does innovation come from?

- You need secret knowledge, that is defendable.

Where does secret knowledge come from?

- Secret knowledge can come about by:

- (i) integrity and

- (ii) hard work - this is the secret sauce. In all hard work, there is profit. In working hard, you will realise what is taxing and painful: this is a signal for you to ameliorate that problem. This requires a base level of integrity.

- (iii) in trying to reduce costs.

- (iv) by talking to your existing clients or stake holders. If the complain: pay attention - and solve those problems.

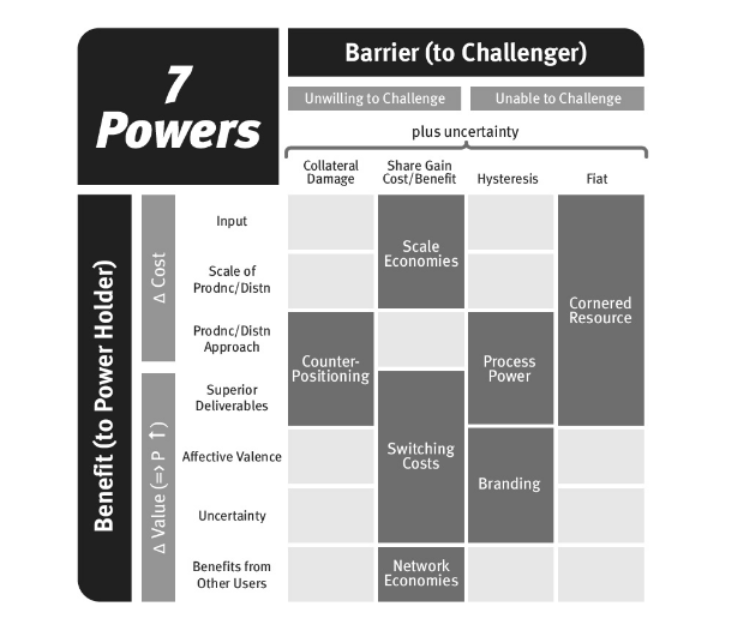

Scale Economies

When you have a large base - over which you can spread your fixed costs. This allows you to charge lower than your competitors.

e.g. if I make a movie costing $100m and I have 100m subscribers, I can charge a subscription fee of just $1 / subscriber. But if a competitor wants to make the same movie, but has only 1 subscriber - then they will have to charge that guy $100m!

The Ideal scenario:

In other words, for scale to work you really need:

- fixed costs to be very high.

- and for your subscriber base to also be very high - in comparison to your competitors.

Or to put it a different way - it would be ideal if by some means you managed to smash your fixed costs down to a very low number, but have your competitors have a very high fixed costs, with a low subscriber base. The benefit? You can charge a nice margin, while not being touched by competitors.

Network Economies

Where something becomes more useful, the more people that are added into the network:

-

e.g. having a phone is useful – only if you can call someone with it. The more people you can call, the more useful the phone network is. Correspondingly - if you were to set up a rival phone network: why would anyone sign up to a network where there is no one to call?

-

Consequently, networks that scale fast, and early, will probably take the cake in that particular niche.

In an ideal network:

- the benefit which accrues to each network member, as an additional users is added, must be very, very high.

- you must have a very large network, compared to your competitors.

- your surplus leader margin increases with: (additional benefit of an incremental user) / variable cost. The higher the benefit of an additional user, and the lower variable cost of acquiring and maintaining them - the more dominant your position.

It is difficult to ascertain:

- potential number of nodes in a network.

- plus the difficulty of estimated the benefit of an additional user to the network.

There are other benefits of a network:

- Demand side network effects: e.g. as more people get into the smart phone market - then more developers get on it. As this happens, it is harder for people to switch to a new operating system - because all of those same apps might not exist on the new system.

Counter positioning

When you have a superior business model, but the incumbents do not switch to this superior model. Why not?

- They would cannibalise their existing operations.

- They have no “power” in the new way of doing things.

- There is uncertainty in the success of the new methodology, or

- the new model seems counter-intuitive. e.g. Ned Johnson of Fidelity asked: “Why would anyone settle for average returns?”

- Agency issues: the CEO might not personally gain fromm a new strategy, even though the firm gains.

Eventually, as incumbents catch on to the new way of doing business, they may enter the market.

Switching Costs

- If there is high switching costs: people will be encouraged to stay.

There are three categories:

1. Financial switching costs

Buying you equipment etc.

2. Procedural

Training people.

3. Relational

Cutting loose from sales teams, dealing with people you like etc.

Examples of switching costs:

- Apple’s ITunes - all music downloads are in a properietary format, which you cannot (easily) transfer into competing music devices. If you decide to switch, then you forfeit all your previous purchases.

- There may be: retraining costs, headaches with migrating data, risk of of lost business if things to wrong etc.

But here’s the problem. Competing products may also have switching costs - these issues may be transparent. Accordingly, everyone will know the benefit of acquiring a new customer, and will compete hard for each customer, and this arbitrage will drive down their margins.

What is the benefit of high switching costs, if you are not able to sell additional services? If you provide value-additive services, especially services that others cannot provide, then you might be compelling.

-

On the flip side: people may be reluctant to buy-in to a product where they are locked in. e.g. with any Google product - I am very, very nervous. Would I trust my data with these guys? Hell no. I made the fatal decision to jump into their music offerings - but they shelved that.

-

if you have a poor reputation of protecting your customers: then your customers will avoid trusting you. e.g. After Trimble screwed over all their perpetual license holders on their steel detailing software, I am very, very nervous about purchasing expensive Trimble products - especially their software: especially “perpetual” licenses and maintenance fees. Because you never know - tomorrow, they may turn around and offer their software services to others at 1/10th of the price, or they may decide to unilaterally jack up their software prices.

Branding

Benefit of branding is that you can charge higher prices, than the exact same commoditised product (without the brand). Some reasons:

- Affective valence: a perception that the product is good etc.

- Uncertainty reduction. e.g. you don’t know whether the diamond is actually real - but because you trust Tiffany’s, you go there for ‘peace of mind’, and are paying premium, because of that trust.

The only way you can build a brand is via a long period of consistent behaviour (hysteresis), and by not debasing your name by taking short-cuts.

Debasement: e.g. Halstom destroyed it’s high end brand by creating a line for JC Penney (a cheap clothing retailer). They never recovered from this branding snafu.

Counterfeiting: If someone tries to create the same product, with a counterfeit label: how are you going to stop that?

Geography: You may have a brand in one locale, but not another. e.g. Sony’s power in the USA, which did not exist in Japan.

A brand need not be exclusive. e.g. Titleist vs TaylorMade may have brand recognition over no-name brands.

Types of Goods which have branding potential:

- Magnitude: goods which may fetch a higher price in future. Business to business goods are less likely to be able to attach a brand premium, because deliverables are more important. Consumer purchases however, are more driven by affective valance.

- Risk mitigation e.g. in medicine, choosing a “safe” brand rather than a cheaper “riskier” one.

- Duration Must be consistent for a long period of time.

Cornered Resource

Definition: preferential access to a coveted asset that independently enhances value.

e.g. Pixar’s team: the “Brain’s trust” - they shared outstanding success compared to other successful films. Arguably, Aristocrat Leisure Limited (ALL )is in a similar position with their team of designers / programmers: ALL machines are an order of magnitude better than comparable machines. Why? Their games are more addictive / popular. Why? Because their team of designers has some hidden knowledge, which makes their games better. Good luck trying to lure away one of their key game designers!

- Idiosyncratic: Others must not be able to easily replicate this coveted resource.

- Non-arbitrage: You may have a coveted resource, but if you pay a high price, then this will not give you a differential return. e.g. hiring Stephen Speilburg to direct a movie might be great, but if his fees are astronomical, that will lower your return.

- Transferrability: you need to correctly identify the resource if you want to successfully transfer them.

- On-going: you need lasting benefits. e.g. a patent that lasts forever.

- Sufficient: the cornered resource is all you need for differential returns.

Process Power

e.g. Toyota’s production system. At Toyota, there is a philosophy, an invisible conscience the guides the decisions of staff + investment. This cannot be readily copy-catted by taking a 1-hour tour. You may copy the outcome, but how do you copy the process by which that outcome was produced? Many have tried to adopt TPS strategy’s, but all have failed.

1. Complexity / Difficulty:

Getting your suppliers to understand and implement your philosophy is not easy.

2. Opacity

The full system is actually opaque. I would liken it to a religion or philosophy that is infused in the minds of employees.

Trying to copy Toyota’s philsophy by inspecting their factory would be akin to showing you Tiger Wood’s golf swing during his 1999-2000 era and asking you to go and replicate it. Just by watching it? You will probably fail: your understanding of the swing would likely be imperfect: how can you understand the reasoning / philosophy and the decisions which made the swing what it was in the first place? e.g. wide-and-wide, less across the line, less driven by timing, making the hips act in concert with the arms, less flipping: consistency over distance, a willingness to make the changes required to make the swing consistent, a willingness to do the drills, and put in the work: 1000s of hours of difficult practice, lifting in the gym - all of this was developed under the tutelage of Buch Harmon - which itself is effectively a cornered resource.

You cannot possibly adopt Toyota’s philosophy by inspecting Toyota’s factory: you must understand and break into the mind of each worker, and the decisions which impel him towards a better outcome for his company.

e.g. The guys in Royota Australia are thinking: how can I maximise my overtime? e.g. It takes a full 15 min just to open up this Excel Spreadsheet, let alone to do anything with it. This is great: more overtime money for me, so I can cruise on Reddit.

On the other hand: a more productive / ethical Japanese worker would ask: why are we using Excel? Why don’t we use a proper relational database for this task. I am skilled and competent: I can set it up. Let me ask management. Management said ok, but was askance about it, because it would affect a few bludgers’ overtime. The task was accomplished, but not without considerable objection. I have zero doubts that this would not occur in Japan: the workers are ethical, and every one is playing on the same team: the game is to reduce costs and improve quality, regardless of who benefits personally.

Ruthless Cost Cutting

The better you cut your costs (compared to your competitors) then the better your advantage.

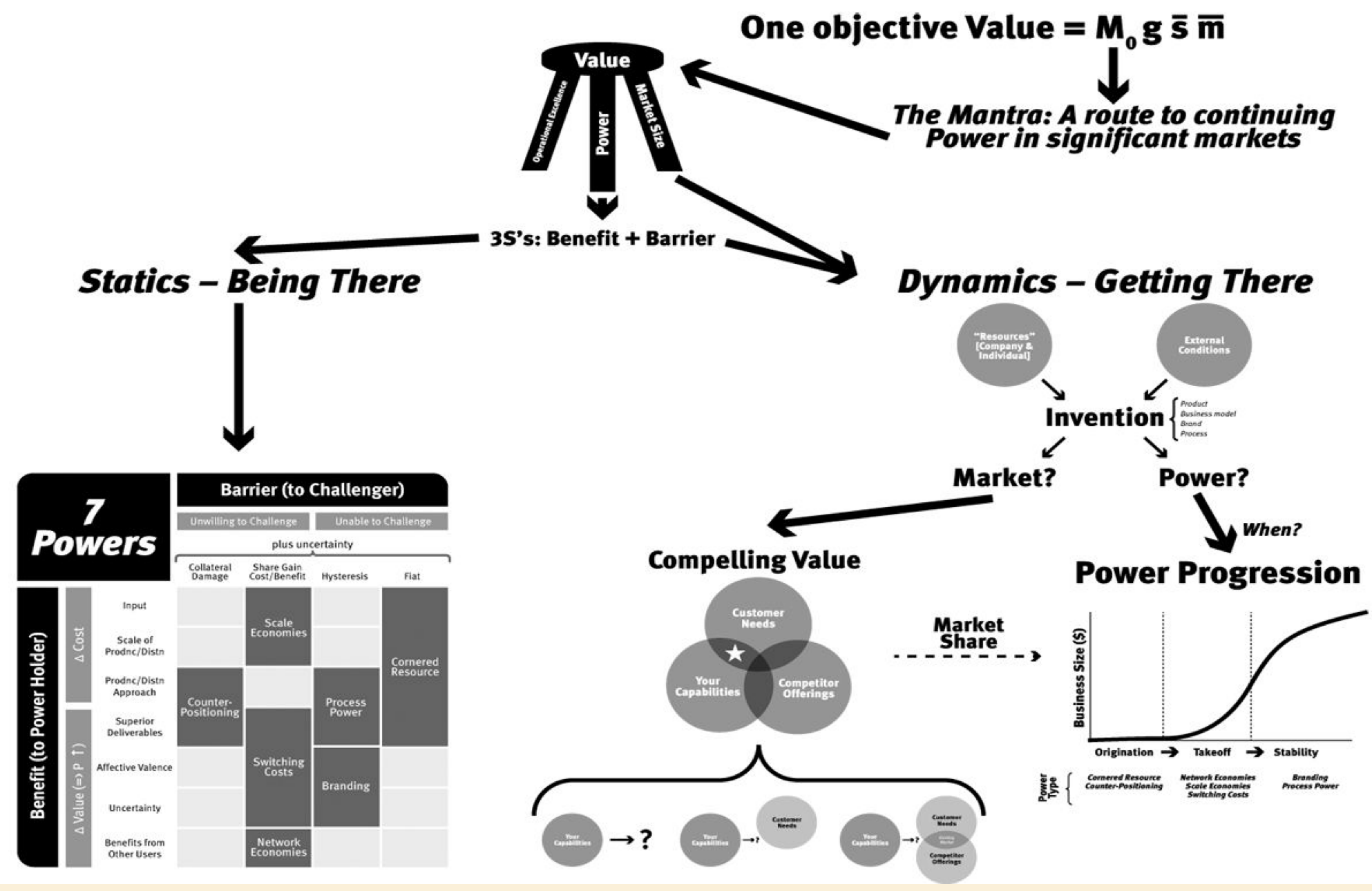

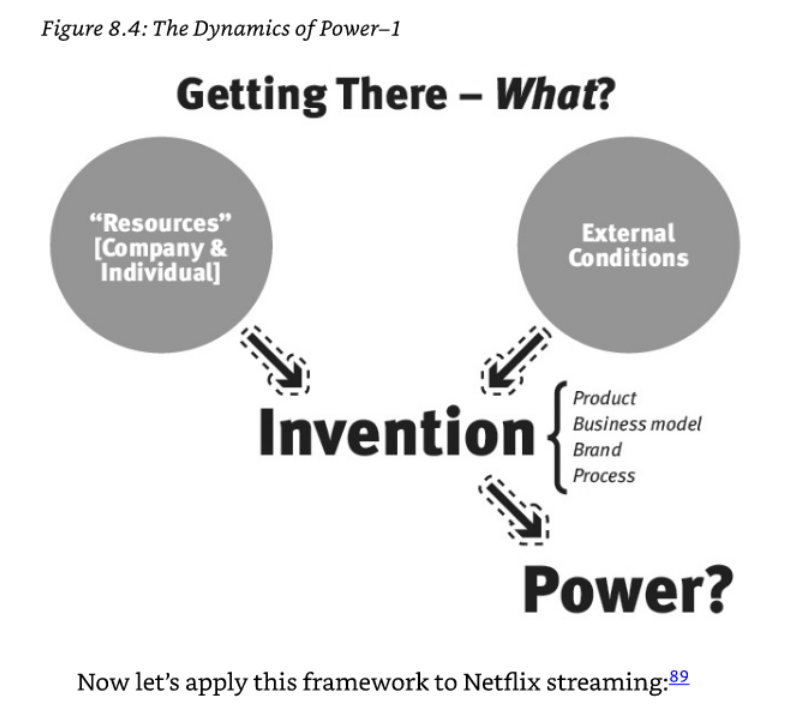

Getting Power

Use your existing resources, and external conditions to: innovate. Once you innovate, you NEED one or more of a combination of the above powers to better secure yourself from having your margins eroded away. Your offering must be a “MUST HAVE” i.e. it must be super compelling.

Compelling Value

There are three ways. All of them require

(1) Capabilities led value

i.e. You are good at something, so you try and retro-fit it into a product which you think someone might want. I disagree with this approach, concurring with Steve Jobs:

Most people don’t know what they want, until you show it to them.

Customer Led Compelling Value

You invent something, that nobody else could have done before, and that is extremely compelling. e.g. Fibre Optics.

Competitor Led Compelling Value

- i.e. a competitor already has a product, that you can make x10 better, such that people will have a “gotta have” response.

(1) Will the new features be differentially attractive? (2) Will existing competitors be delayed?

Typically you need commitments up front, and you’ll get competitive responses relatively quickly. i.e. with the IPhone you need telecommunication companies to cooperate with you.

Case Study: Intel

Why Intel Took off?

Innovation: in their chip design - they made it good, really good.They convinced IBM to incorporate that chip. Chip is cheaper, but not as good as IBM’s.

Fixed Cost:

- Fixed cost for design, then sell as many as possible, on top of IBM’s PC.

- Fixed cost for factory: because they have a simple design. Which is apportioned across all their factories.

- Lithography advancements: because of scale, they can invest in making a better chip (i.e. factory) - they can become early movers.

Vertical Integration

- People buy PCs for the applications. Except the applications: Lotus 123, MS DOS had a hard dependency on Intel. Furthermore:

- Switching Costs: programs were built for the Intel chip, so people got used to the program. Cornered resourceTheir innovation in chips which they bought back from the Japanese company.Their execution and managemeentt team

Power needs both a benefit and a barrier.

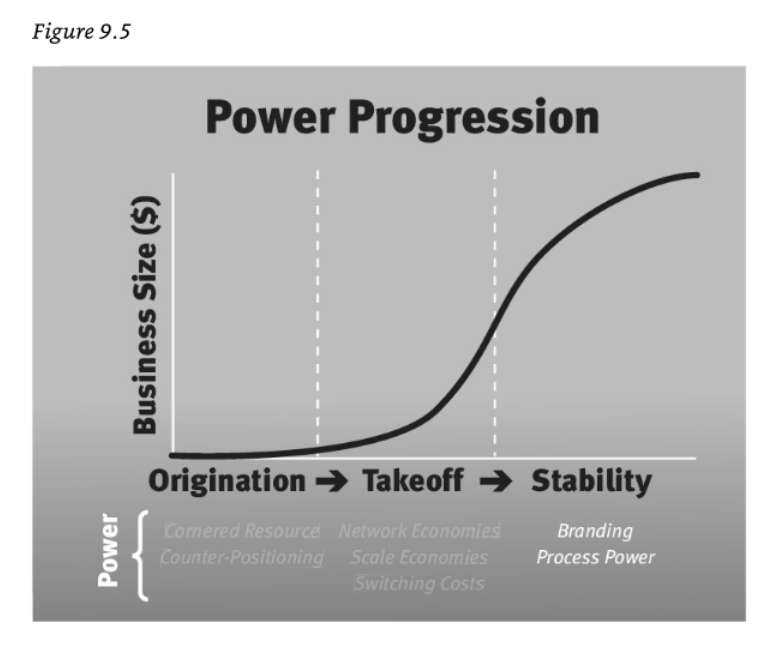

How did Intel get there? (Power Progression)

Cornered Resource: the invented something, then purchased the rights to their invention from Busicom. Then they had an excellent management team. The resource must be underpriced for it to qualify as a cornered resource. Then they obtained Network and scale economies, and high switching costs. Then came branding and probably process power. But it all started with innovation, which was expensive and difficult, and probably very useful.

Other firms may have powers in the following stages:

Final Charts

- Look at where you are in the power progression. Ask whether you have power; seek to establish powers you don’t have. And this comes with innovation.

- Me too won’t do. You need an advantage.